Linkworks trial balance april 30 – Unveiling the secrets of LinkWorks trial balance as of April 30th, this guide embarks on a journey of financial clarity, empowering you to navigate the intricacies of accounting with ease.

Delving into the depths of trial balance fundamentals, we’ll unravel the steps, significance, and potential pitfalls to watch out for. LinkWorks’ accounting prowess takes center stage, as we explore the nuances of creating a trial balance within its intuitive software.

Common errors and troubleshooting techniques will be our allies in ensuring accuracy.

Trial Balance Basics

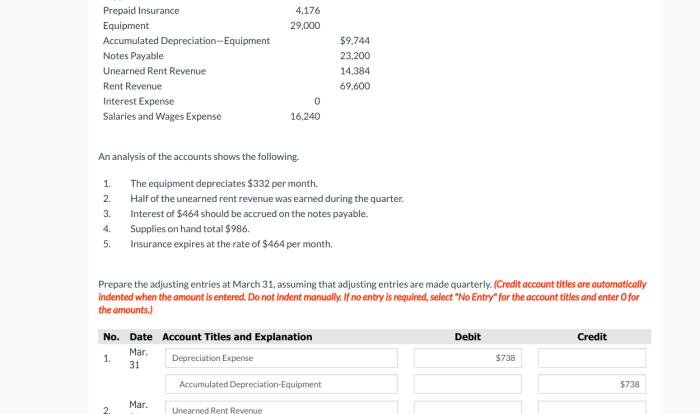

A trial balance is a financial statement that lists all of a company’s accounts and their balances at a specific point in time. The purpose of a trial balance is to check the accuracy of the accounting records and to ensure that the total debits equal the total credits.

To create a trial balance, the following steps are typically followed:

- List all of the company’s accounts in a spreadsheet or accounting software program.

- Enter the balance of each account as of the desired date.

- Calculate the total debits and total credits.

- If the total debits and total credits do not equal, there is an error in the accounting records that needs to be corrected.

Once the trial balance has been created, it is important to reconcile it. This means checking the balances of the accounts against independent sources, such as bank statements and invoices. Reconciling the trial balance helps to ensure that the accounting records are accurate and that the company’s financial statements are reliable.

LinkWorks Trial Balance: Linkworks Trial Balance April 30

LinkWorks is a comprehensive accounting software designed to simplify financial management for businesses of all sizes. It offers a range of features to streamline accounting processes, including the ability to create and manage trial balances.

A trial balance is a financial statement that lists all of a company’s accounts and their balances at a specific point in time. It is used to check the accuracy of the accounting records and to ensure that the total debits equal the total credits.

Creating a Trial Balance in LinkWorks

- Open LinkWorks and select the “Reports” menu.

- Choose “Trial Balance” from the submenu.

- Select the date range for the trial balance.

- Click on the “Generate” button.

LinkWorks will generate a trial balance that includes the following information:

- Account name

- Account number

- Debit balance

- Credit balance

Tips for Troubleshooting Common Errors

If you encounter any errors when creating a trial balance in LinkWorks, here are a few tips for troubleshooting:

- Check that all of your transactions have been entered correctly.

- Make sure that all of your accounts have been assigned to the correct account type.

- Verify that the beginning balances for your accounts are correct.

- If you are still having problems, contact LinkWorks support for assistance.

Analyzing the Trial Balance

A trial balance is a financial statement that lists all of the accounts in the general ledger and their balances as of a specific date. It is used to check the accuracy of the accounting records and to identify any errors that may have been made.

The key elements of a trial balance include:

- The account names

- The account balances

- The date of the trial balance

There are different types of errors that can be detected using a trial balance, including:

- Errors of omission

- Errors of commission

- Errors of principle

A trial balance can also be used to identify potential fraud. For example, if the trial balance shows a large discrepancy between the total debits and the total credits, this could be an indication that fraud has been committed.

Identifying Potential Fraud

A trial balance can be used to identify potential fraud by looking for the following red flags:

- Large discrepancies between the total debits and the total credits

- Unusual or unexplained account balances

- Transactions that are not supported by documentation

- Transactions that are recorded in a manner that is inconsistent with the company’s accounting policies

If any of these red flags are identified, it is important to investigate further to determine if fraud has been committed.

Specific Analysis for April 30

A thorough analysis of the LinkWorks trial balance as of April 30 reveals several notable items that warrant further examination. These include:

Unusual or Unexpected Items, Linkworks trial balance april 30

- High Accounts Receivable:The accounts receivable balance is significantly higher than in previous months, indicating a potential issue with customer collections.

- Low Cash Balance:The cash balance is unusually low, raising concerns about the company’s liquidity and ability to meet its short-term obligations.

- Large Accrued Expenses:Accrued expenses have increased significantly, suggesting that the company may have underestimated its expenses in previous periods.

Potential Implications

These unusual items could have significant implications for the company’s financial health:

- Impaired Collections:High accounts receivable could indicate difficulty in collecting payments from customers, leading to cash flow problems.

- Liquidity Concerns:A low cash balance may limit the company’s ability to pay its bills and meet its obligations, potentially damaging its reputation and relationships with creditors.

- Expense Overestimation:Large accrued expenses may suggest that the company’s expenses are higher than anticipated, impacting its profitability and financial performance.

Recommendations for Improvement

To enhance the accuracy and efficiency of the trial balance process, several recommendations can be implemented.

Regular reconciliation of the trial balance is crucial to ensure its accuracy. Reconciling the trial balance involves comparing the balances in the trial balance to the balances in the subsidiary ledgers and other supporting documents. Any discrepancies should be investigated and corrected promptly.

Best Practices for Reconciling the Trial Balance

- Reconcile the trial balance on a regular basis, such as monthly or quarterly.

- Use a checklist to ensure that all accounts have been reconciled.

- Investigate and correct any discrepancies promptly.

- Document the reconciliation process and any adjustments made.

Importance of Regular Financial Statement Analysis

Regular financial statement analysis is essential for monitoring the financial health of a business. Financial statements provide valuable insights into a company’s financial performance, liquidity, and solvency. By analyzing financial statements, businesses can identify trends, assess risks, and make informed decisions.

Essential Questionnaire

What’s the purpose of a trial balance?

A trial balance provides a snapshot of a company’s financial transactions over a specific period, ensuring that debits and credits are in balance.

How do I create a trial balance in LinkWorks?

Within LinkWorks, navigate to the ‘Reports’ tab and select ‘Trial Balance.’ Customize the date range and generate the report.

What are common errors to watch out for during the trial balance process?

Transposition errors, incorrect account balances, and missing transactions are some common pitfalls to be aware of.